In recent years, many homeowners have found themselves in a unique financial situation: they are benefiting from historically low mortgage rates secured in previous years, while current market rates have risen significantly. This phenomenon, known as the “mortgage lock-in effect,” has notable implications for the housing market, affecting both supply and demand dynamics. Let’s explore what the mortgage lock-in effect is, its causes, and its broader impacts on the housing market.

What is the Mortgage Lock-In Effect?

The mortgage lock-in effect occurs when homeowners with existing mortgages at lower interest rates are reluctant to sell their homes and purchase new ones because doing so would require them to obtain new mortgages at higher current rates. This reluctance can lead to a decrease in the number of homes available for sale, as homeowners choose to stay put rather than face higher monthly payments.

Causes of the Mortgage Lock-In Effect

Several factors contribute to the mortgage lock-in effect:

- Historical Low-Interest Rates: Over the past decade, central banks around the world have maintained low-interest rates to stimulate economic growth. Many homeowners took advantage of these low rates to refinance their mortgages or purchase new homes.

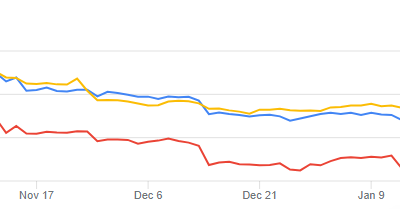

- Rising Interest Rates: Recently, central banks have started raising interest rates to combat inflation and stabilize the economy. As a result, current mortgage rates have increased significantly compared to the rates available just a few years ago.

- Financial Incentives: Homeowners with low-interest rates have financial incentives to stay in their current homes. Moving to a new home with a higher mortgage rate would mean higher monthly payments, which can strain household budgets.

Impacts of the Mortgage Lock-In Effect

The mortgage lock-in effect has several implications for the housing market:

- Reduced Housing Supply: When homeowners choose not to sell, the supply of homes available for purchase decreases. This reduction in supply can create a competitive market for buyers, driving up home prices.

- Decreased Mobility: The lock-in effect can reduce the mobility of homeowners. People may be less willing to move for job opportunities, better schools, or other reasons if it means giving up their low mortgage rates.

- Impact on Real Estate Markets: Different regions may experience the lock-in effect to varying degrees. Areas with historically low-interest rates and higher current rates may see more pronounced effects, while regions with less dramatic rate changes may be less affected.

- Market Dynamics: The lock-in effect can influence market dynamics by shifting demand toward rental properties or smaller homes that require lower mortgage amounts. This shift can impact the rental market and housing development trends.

Strategies for Homeowners and Buyers

For homeowners and buyers navigating the mortgage lock-in effect, several strategies can be considered:

- Refinancing: While current rates may be higher than historical lows, they may still be lower than the rates you originally closed on. Homeowners should explore refinancing options to secure the best possible rate.

- Adjustable-Rate Mortgages (ARMs): For those considering purchasing a new home, adjustable-rate mortgages may offer lower initial rates compared to fixed-rate mortgages, potentially offsetting some of the impact of higher rates.

- Renting: Buyers who are deterred by high mortgage rates may consider renting as a temporary solution until rates stabilize or decrease.

- Market Timing: Potential buyers and sellers can keep an eye on market trends and interest rate forecasts to make informed decisions about timing their transactions.

Conclusion

The mortgage lock-in effect is a significant factor shaping the current housing market. As homeowners with low mortgage rates opt to stay put, the reduced supply of homes for sale can create challenges for buyers and influence broader market trends. Understanding this effect and considering strategic approaches can help homeowners and buyers navigate this unique economic landscape. Whether through refinancing, exploring different mortgage options, or timing market moves, informed decisions can mitigate the impact of the mortgage lock-in effect on personal finances and housing goals

If you are a broker, lender, or homeowner that needs AMC appraisal services please contact us.